HKMA scraps 20,000 yuan daily conversion cap in landmark reform

2014-11-12

Ending 20,000 daily limit the latest step in Beijing's internationalisation of the currency

■HKMA chief Norman Chan says the daily cap to exchange Hong Kong dollars for yuan will be lifted starting on Monday when the Shanghai-Hong Kong Stock Connect scheme is launched. Photo: Sam Tsang

Hong Kong will allow the city's residents to convert yuan freely from Monday - a landmark reform that marks the latest step in the internationalisation of the tightly controlled currency.

The move will see the daily conversion limit of 20,000 yuan, in place since 2004 in a bid to stymie currency speculation, scrapped. It paves the way for a freer flow of yuan in one of the world's busiest international financial markets.

The change, announced yesterday by Hong Kong Monetary Authority chief executive Norman Chan Tak-lam, takes effect on the day the 550 billion yuan (HK$700 billion) Shanghai-Hong Kong Stock Connect scheme to link share trading in China's two biggest financial centres begins.

"The removal of the daily conversion limit will facilitate Hong Kong residents' participation in the Shanghai-Hong Kong Stock Connect as well as other investments and transactions denominated in the yuan," said Chan.

The city has allowed non-residents to convert unlimited quantities of yuan daily since 2012.

Demand for yuan ahead of the launch of the stock market "through train" has soared, forcing banks to increase deposit rates several times since September in a bidding war to secure enough funds for the scale of trade anticipated. Scrapping the conversion cap by allowing residents effectively to tap into the offshore yuan deposit pool of 1.1 trillion yuan eases that pressure.

■Piling up: Yuan deposits in offshore centres (yuan billion)

Controls will remain on yuan remittances to the mainland by holders of Hong Kong bank accounts. The daily limit of 80,000 yuan will not change and cross-border travellers will still have to declare physical holdings of 20,000 yuan or more.

Analysts saw yesterday's move as a critical step in Beijing's efforts to open up its capital markets and promote the yuan as an international currency.

"This regulatory change is a positive step for the broader growth of the offshore (yuan) foreign exchange market," HSBC currency analysts wrote.

Beijing has promoted the yuan's use for settling trade in goods since 2009 in a bid to end the dominance of the US dollar and reflect China's emergence as the world's biggest exporter. That effort has made the yuan the world's seventh-most used currency for payments, but tight limits on convertibility for financial transactions have prevented it becoming an instrument of choice for global investors.

Analysts see that as a crucial next stage of development for the yuan before it can achieve reserve currency status for the world's major central banks and give Beijing influence in institutions like the International Monetary Fund, which set rules for the global economy and are dominated by the US and Europe.

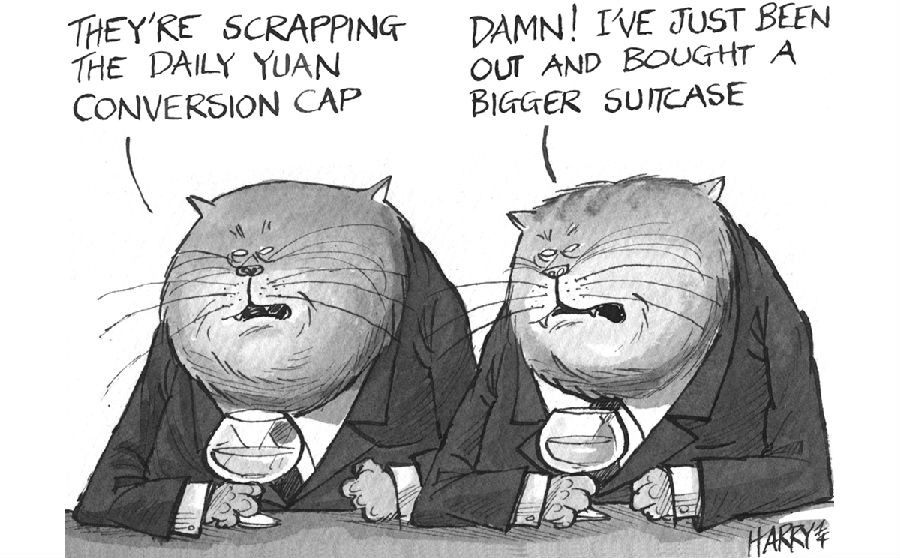

■Harry's view