Improving AML compliance: Best practice amid tightening rules

2015-5-11

Efforts to track dirty money in the banking system have come underscrutiny this year. From the very public troubles of global banking empireswith a significant footprint in Hong Kong through to critiques in the businesspages of the city’s newspapers, no part of the anti-money laundering (AML) andterrorist financing regime has escaped scrutiny.

Much of the heat has fallen directly onto the banking system.

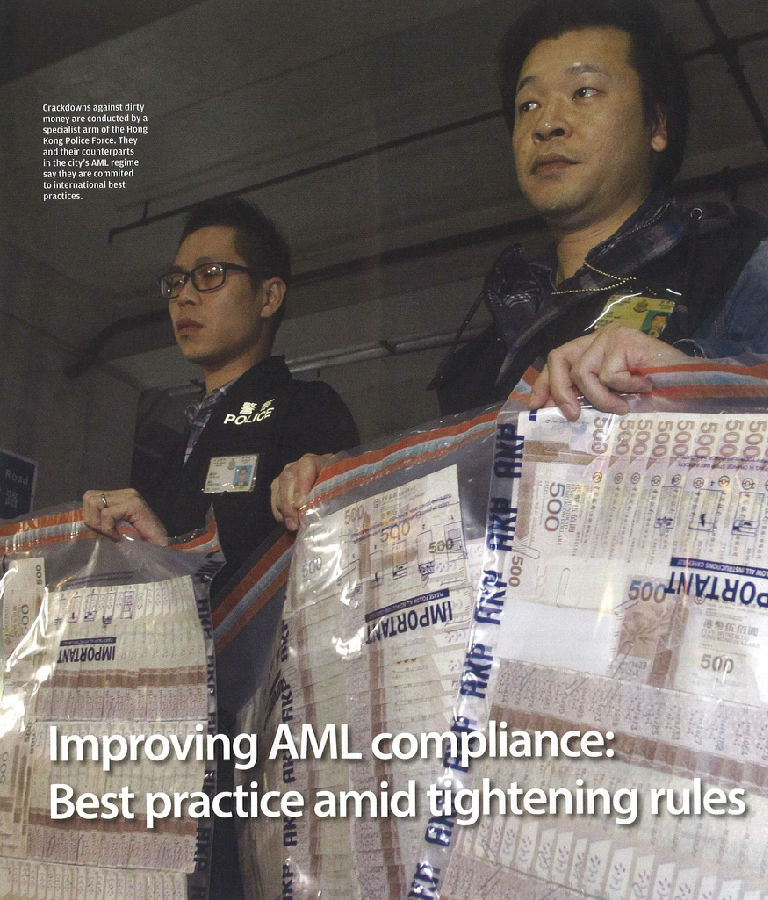

The Joint Financial Intelligence Unit (JFIU) is a specialist arm ofthe Hong Kong Police Force tasked with investigating suspicious transactionreports (STRs) stemming from the broader financial services sector.

Last year, 83.6 per cent of STRs received by the unit were createdby the city’s banks. Factor in that the 37,188 reports issued last yearrepresented an increase of about 83 per cent compared to 2011, and it mightseem AML efforts are failing.

A police spokesman told Banking Today that not every STR should beconsidered a case of money laundering. Inquiries often do not result in aformal investigation.

Indeed there were 151 people convicted of money laundering offenceslast year and the value of assets restrained was HK$418.9 million, down fromthe 246 convictions and HK$1.21 billion recorded in 2011. The Hong KongMonetary Authority (HKMA) says the increase in transaction reports is a signthat AML and combating the financing of terrorism (CFT) controls are working.

"These figures compare favourably with other comparableinternational financial centres and suggest increasingly mature, well-developedAML/CFT systems and controls in banks," says Stewart McGlynn, the Head ofAnti-Money Laundering and Financial Crime Risk Division, Banking SupervisionDepartment of the HKMA.

STEPPING UP SURVEILLANCE

A former Deputy Chief of the Joint Financial Intelligence Unit,McGlynn says the banks have recognised and are meeting their responsibilities"as gatekeepers to Hong Kong’s financial sector".

A high number of reports is not necessarily an indication of thesystem’s shortcomings, he says, stressing that there are a number of factors atplay.

"One conclusion that should be drawn from that assessment isthat the figures reflect the increasing ability and willingness of banks toreport suspicion and take robust actions to reduce financial crime risk,"he says.

McGlynn declined to comment on specific cases or to elaborate on theexact details of Hong Kong’s enforcement actions.

By international standards, the city is compliant with the standardsset by the Financial Action Task Force (FATF), the key global body to overseeand assess AML regimes, in that most banks have generally developed effectiveAML-CFT control frameworks.

The task force is next scheduled to assess the effectiveness of thecity's AML measures in 2018.

"I’m very encouraged by what I see," says Simon Topping,the Head of KPMG's Financial Services Regulatory Centre of Excellence for theAsia- Pacific region.

"I see the banks moving from a stage where they just do theminimum they have to do to satisfy the regulatory requirement, to actuallygetting the point that this is something serious and being moreproactive."

Topping's division specialises in advisory, risk consulting andfinancial risk management. He himself spent a number of years in the mid-1990sto mid-2000s working for the HKMA.

WHERE THE GAPS EMERGE

Topping has observed a shift in the way AML policy is implemented bythe banks.

That’s partly been imposed by government legislation, but it alsoreveals a desire to be good corporate citizens.

The evolution from a bolt-on to the compliance function, to acentral part of day-to-day banking business that requires constant improvement,has seen the banks meet demanding regulatory requirements in what is veryclearly a rapidly evolving environment.

"We're in a transition period where people are doing a muchbetter job of identifying the raw suspicious transactions but not all are yetperhaps at the stage where they can filter it down to the ones that they shouldfocus on," Topping says.

In a recent assessment of the banking sector's AML efforts, KPMG’sHong Kong Banking Survey 2014 identifies a number of areas where banks couldimprove. The report suggests the collection of data and its management could beimproved to show more accurately where due diligence is being carried out.

The report also calls for a regular review and assessment of AMLsystems and practice, and suggests that banks have a plan in place whenweaknesses are detected in their AML controls.

Hong Kong’s banks had found it difficult to maintain high standardsin the past, Topping says, in part because of an inconsistent application ofpolicy and also because "maybe there were too many exceptions beingmade".

But he maintains that any undue criticism of the banks is often unwarranted.

"Sometimes people are being criticised for not meetingrequirements that didn’t even apply at the time," he says.

"It's quite unfair some of the things people are beingcriticised for, saying they are required to do this and they didn’t do it, butwe’re talking about five years ago when that requirement wasn’t in place."

A BALANCED APPROACH

Central to each of these pressure points is risk management andpolicy. An institutional risk assessment could potentially identify whereshortcomings exist within the bank, but policies also needed to be clear andneeded to be followed.

The know-your-customer controls, while rigorous and well understoodby most staff, might perhaps include a wider range of variables to bettermanage risk, for example.

Topping says that having acknowledged that AML is not just acompliance issue, but an issue for the reputation of the institution, bankleaders must be "more forward looking and proactive".

They also had to be prepared to "spend money and take action onAML which is beyond the minimum the regulation requires".

Spending is part of the problem.

It's estimated that banks in the US spend US$7 billion a yearkeeping pace with AML regulations from the FATF, and profitability at even thebiggest of global finance groups has been hurt by constant increases incompliance costs.

The costs of compliance and the price tag of automated systems herehave also increased. It has left some smaller banks vulnerable in terms of bestpractices, Topping says.

But most banks are getting the balance between enforcement and costsright and are focusing on consistent application of group standards acrosscultures and locations.

For its part, the FATF last year clarified the need for a risk-basedapproach that should be less costly to enforce because it allows for a moreflexible use of resources.

The risk-based approach should filter through to the way regulatorsenforce the law.

CONTINUAL IMPROVEMENT

Each of the parties involved in Hong Kong's AML regime say they arecommitted to improvement to stay in sight of global best practice.

"If you look outside Britain and the United States, which arewhere the regulators are taking it most seriously and where the banks aretaking it most seriously, I’d say Hong Kong and Singapore are best-practiceleaders", Topping says.

The HKMA has increased its specialist resources for AML work tomatch the increasing expectation globally for jurisdictions to strengthen theirregimes.

"For example, in 2013 we conducted 19 of these [supervisory]reviews, which were increased to 36 in 2014," McGlynn says. "Thiscompares, for example, with Min 2012.

"The HKMA considers that banks should devote sufficient seniormanagement attention and adequate resources to this important area of work tofoster a stronger AML-CFT risk culture," he adds.

For its part, the JFIU says it will work more closely with allstakeholders in worldwide efforts to stamp out money laundering, includingoverseas financial intelligence units, local and overseas law enforcementagencies and regulatory bodies.

The police spokesman told Banking Today that more than 1,000frontline Hong Kong Police Force officers have now been trained in financialinvestigations and are capable of undertaking AML inquiries.

With improved enforcement measures a likely evolution of the AMLregime, Hong Kong’s banks will need to work harder to meet the difficult, oftenshifting, best practices required to reduce money laundering.

They will be able to meet the challenge with the commitment offront-line bank staff to their banks' internal reporting system, and thecommitment of their managers to assess, update and be more proactive in AMLcompliance.

Principles of a risk-based approach

The Financial Action Task Force is the key global body to overseeand assess anti-money laundering regimes around the world. It recommends whatit calls a risk-based approach.

In its most comprehensive and recent guidance issued in October 2014it offered a series of guidelines and examples of best practice.

For banks assessing their compliance to current legislation, itoffers a list of suggestions.

- Set up staff training on mechanisms to adequately detect unusualtransactions.

- Establish adequate channels to allow staff to report unusualtransactions to the compliance officer.

- Ensure confidentiality to staff reporting suspicious transactions.

- Allow staffto report areas of policy or controls they find unclearor ineffective.

- Establish ongoing consultation channels for staff.

- Ensure consistency of the answers given to staff questionsconcerning AML issues.

- Conduct AML activities In such a way that they are perceived byall staff as a support to the quality of the banking services provided toclients and the integrity of the bank.

Up-to-date guidance is available at http://www.fatf-gafi.org/documents/guidance